Summary

After modeling for the optimal price, one that maximizes demand level, and after normalizing demand across various sized organizations, I find that Kiva Products on average are about 8% overpriced when comparing the average historical price items have been sold across all time, vs. the price that successful retailers are selling these products to acheive the maximum product sell-through possible at their retail locations.

To summarize the findings by product:

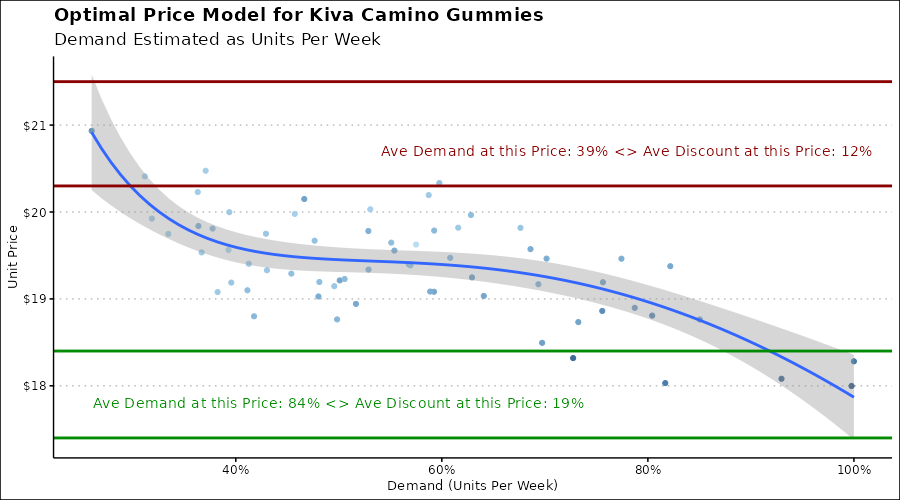

To achieve maximum demand for Camino Gummies, products are selling at an average discount of about 21% with a final out the door price of roughly $18.

To achieve maximum demand for Kiva Chocolate Bars, products are selling at an average discount of about 18% with a final out the door price of roughly $20.5.

To achieve maximum demand for Kiva Terra Bites, products are selling at an average discount of about 17% with a final out the door price of roughly $21.

For a breakdown of the methodology and technical analysis results, see below.

Background

Kiva is a very important brand in the cannabis market. Kiva brand offers many types of edible products. Notably, Gummies, Chocolate Bars, Chocolate covered bites (espresso beans, blueberries), and various flavors of Mints.

Kiva products make up roughly 9% of the edibles market as shown in our data. Of all the Kiva branded products, here is the share of each (within Brand Kiva products being sold):

| Sales Since 2019 | Units Sold Since 2019 | Average Unit Price | Average Discount | Share of all Kiva Sales | |

|---|---|---|---|---|---|

| Kiva Camino Gummies | $16,512,816 | 841,581 | $19.9 | 13% | 62.5% |

| Kiva Chocolate Bars | $4,035,526 | 189,080 | $21.5 | 15% | 14.0% |

| Kiva Terra Bites | $3,572,374 | 157,131 | $23.0 | 12% | 11.7% |

| Kiva Mints | $1,798,838 | 101,586 | $17.8 | 9% | 7.5% |

| Kiva Other Products | $1,232,026 | 58,129 | $21.4 | 11% | 4.3% |

Objective

The objective of this analysis is to identify the optimal price point of the top 3 Kiva products offered on the market. The aim is to develop a price-demand model based on the observed sell-through rate (i.e. Demand) of each product and changes in the price. The model will identity the correlation between sales and demand

Methodology

The observed sell-through rate (also referred to as Sales Velocity) is first estimated as Units Sold Per Week and calculated at the org and facility level.

Once I have this weekly metric for every org and facility (with data going back to 2019), I calculate the average weekly price of each of the Kiva product segments in focus (Gummies, Chocolate Bars, and Terra Bites), as well as the weekly average percentage discount rate offered to retail customers.

Next, since each org offers these products to a varying sized customer base, the value of Unit Sales per week isn’t an appropriate relative comparison across orgs; therefore in order to understand demand, I must normalize Sell-Through velocity.

The normalized velocity is then called ‘Demand’ and expressed as a percentage between 0 and 100, where 100 represents the observed maximum demand level for any given org.

After retrieving the normalized weekly demand for every org, I then model the correlation between price changes and changes in percentage demand. The results give us an indication of the price level which maximizes demand across all orgs.

Furthermore, the demand level can be grouped to give us summary statistics that offer an indication of the discounting performed to reach such a price.

Note about the Model:

Demand is expressed as a function \(Demand = F(P)\); where \(F(P)\) (being a function of Price) is estimated with the following equation using a Generalized Additive Model (GAM): \(F(P) = B_2(ln(P) * ln(P + 1)) + B_1\). This Model gives us the expected shape of a price/demand relationship and the data supports such a fit as can be seen in the results section below.

For this model, the term \(B_2\) can be considered the price elasticity of demand depending on the product type (Chocolate Bar, Camino Gummy, or Terra Bites) and \(B_1\) is considered the minimum level of demand for such a product. The accuracy metrics for this model are the model \(R^2\), the model \(p-value\) as well as the model \(F-statistic\). The accuracy for this model ranges from 80% (Kiva Terra Bites) to 90% (Kiva Chocolate Bars) while the confidence interval around the model’s fit is 95%.

Results

The model fit on the historical data is shown in the figures below, however the following table highlights the summary of the output (e.g. optimal price that maximizes demand) that is extracted from the models for each product.

| Product | Optimal Price (Model Output) | Current Historical Average Price |

|---|---|---|

| Kiva Camino Gummies | $17.9 | $19.9 |

| Kiva Chocolate Bars | $20.5 | $21.5 |

| Kiva Terra Bites | $20.9 | $23.0 |

Kiva Camino Gummies

In summary, to achieve maximum demand for Camino Gummies, products are selling at an average discount of about 21% with a final out the door average price of roughly $18.

The following plot describes the model being fit on normalized demand data for all orgs. The x-axis describes the percentage demand which is simply the normalized product sell-through velocity, while the y-axis is the average unit prices. This plot shows the correlation between changes in price and changes in demand as observed in the data.

The plot below summarizes the average discount level offered seen at various levels of demand while also highlighting the average price of units sold in each group.

Kiva Chocolate Bars (100mg)

In summary, to achieve maximum demand for Kiva Chocolate Bars, products are selling at an average discount of about 18% with a final out the door average price of roughly $21.

Kiva Terra Bites

In summary, to achieve maximum demand for Kiva Terra Bites, products are selling at an average discount of about 17% with a final out the door average price of roughly $20.5.